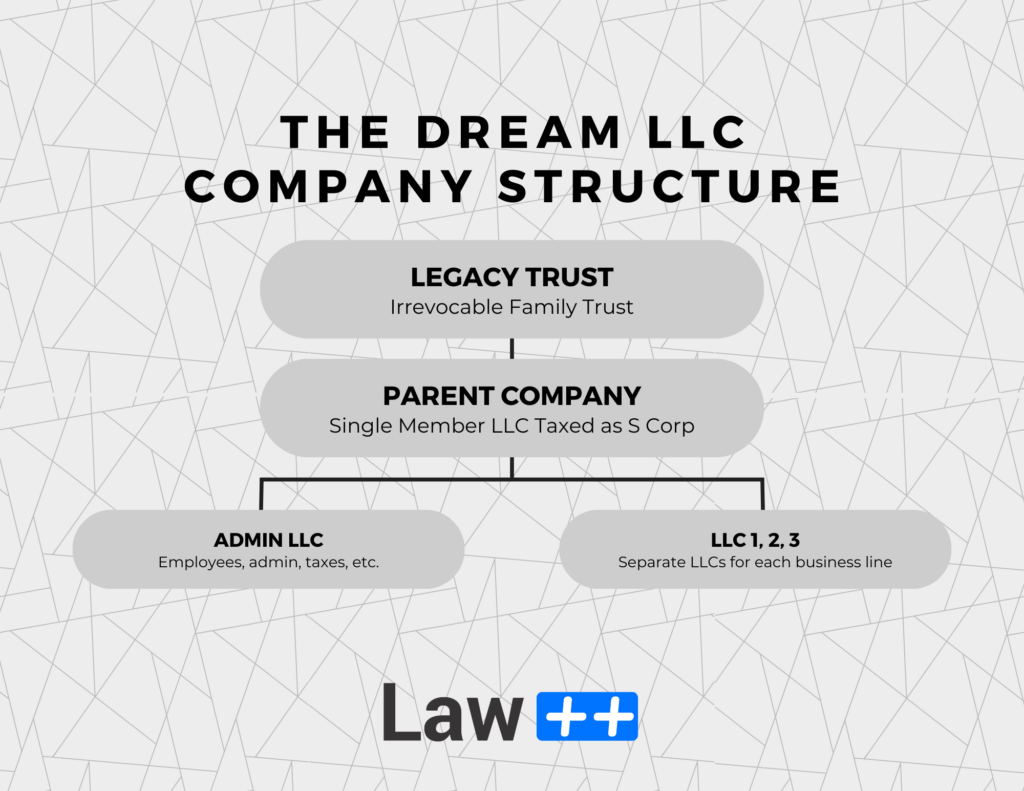

A parent company is, in summary, a company that owns another company. The parent company typically doesn’t do anything except own other companies (subsidiaries or child companies) and take in equity payments from those subsidiaries. In our Dream LLC Company Structure illustrated below, the parent company is the middle of the setup.

What is a Parent Company Legally?

Legally speaking, parent companies are just like any other company. You can make yours a corporation or LLC. Definitionally, to be a parent company, it just has to own one or more other companies. In our setup, we keep it simple. They own companies and funnel money from those subsidiaries to you or your trust.

When Would You Use A Parent Company?

There are three main reasons for this setup:

Firstly, you can positively impact your taxes if you use these right. For example, if you have five LLCs each funneling their money through a parent company, you can elect to have your parent company taxed as an S-Corp. Each of the subsidiary LLCs would be taxed as disregarded so there’s no additional taxation and minimal administrative burden. In this structure, all of your income from all five LLCs would be handled through your parent company.

Secondly, you get a slight boost to your limited liability protection. In the unlikely event someone were to pierce your LLC’s limited liability protection, you’d have a second layer of protection. A plaintiff would have to pierce your subsidiary and then your parent company to reach your personal assets. This is handy, but it’s actually a rare event.

Thirdly, it might make sense from a logistics standpoint to divide up your companies this way. Once you have your third separate company, you start dealing with a lot of logistics. If you start combining a lot of the general services together like accounting, HR, legal, technology, and more, you can save yourself time, energy, and money.

Because every company is different, whether you receive these benefits is based on your individual circumstance.

When You Cannot Use Parent Companies

Like most things in business, this can be a super helpful strategy, but there’s also a chance for abuse. I regularly get clients who think this is a sketchy practice, but it doesn’t have to be. There are more legitimate reasons than there are illegitimate ones.

However, there are illegitimate reasons. You are not permitted, and I would never help a client, set up a parent company for the purpose of committing a crime or fraud (including tax fraud). If you’re trying to hide income or assets from a creditor or the government, you’re already in a bad situation. Just don’t do it. On the other hand, it is perfectly permissible to set yourself up ahead of time to shield your assets or income from future creditors. In the law’s eyes, these are very different scenarios.

Conclusion

The parent company – subsidiary structure can be useful for many reasons. It can save you time, money, and effort if you set it up for the right reasons.